MIDSOUTH BANCORP, INC.

Your vote is important. Whether or not you expect to attend the annual meeting, it is important that your shares be represented and voted at the meeting.

PLEASE MARK, SIGN, DATE, AND PROMPTLY RETURN YOUR PROXY BY FOLLOWING THE INSTRUCTIONS FOR VOTING BY MAIL, OR SUBMIT YOUR PROXY BY FOLLOWING THE INSTRUCTIONS FOR VOTING BY PHONE OR ON THE INTERNET. THANK YOU.

| | | |

| | BY ORDER OF THE BOARD OF DIRECTORS | |

| | | /s/ Karen L. Hail | |

| | | SEVP/Chief Operating Officer | Karen L. Hail |

| | | Senior Executive Vice President |

| | Secretary to the Board | |

| | | | |

MIDSOUTH BANCORP, INC.

102 Versailles Boulevard

Versailles Centre

lafayette,Lafayette, Louisiana 70501

PROXY STATEMENT

This Proxy Statement is being sent to our stockholdersshareholders to solicit on behalf of our Board of Directors proxies for use at our annual shareholders meeting to be held on Wednesday, May 27, 2009,26, 2010, at the time and place shown in the accompanying notice1:00 p.m. at our corporate offices, located at 102 Versailles Boulevard, Versailles Center, Lafayette, Louisiana and at any adjournments thereof. Directions to the annual meeting may be obtained by calling Sally Gary at (337) 593-3010. This Statement is first being mailed to shareholders on or about April 22, 2009.23, 2010. As used in this Proxy Statement, the terms, “we,” “us,” “our” and the “Company” refer to MidSouth Bancorp, Inc.

Only holders of our common stock ("stock") on our books at theas of close of business on March 31, 2009,2010, are entitled to notice of and to vote at the Meeting. On that date we had outstanding 6,788,8849,723,268 shares of stock, each of which is entitled to one vote.

The presence, in person or by proxy, of holders of a majority of our common stock is needed to make up a quorum;quorum for the Annual Meeting. Abstentions will be treated as present for purposes of determining a quorum. In addition, shares held by a broker as nominee (i.e., in “street name”) that are represented by proxies at the Annual Meeting, but that the broker fails to vote on one or more matters as a result of incomplete instructions from a beneficial owner of the shares (“broker non-votes”), will also be treated as present for quorum purposes. Unlike for prior Annual Meetings, under recent amendments to the rules of the New York Stock Exchange applicable to brokers, the election of directors is no longer considered a “routine” matter as to which brokers may vote in th eir discretion on behalf of clients who have not furnished voting instructions with respect to the election of directors. As a result, if you hold your shares in street name and do not provide your broker with voting instructions, your shares will not be voted at the Annual Meeting with respect to the election of directors.

The proposal to elect directors to serve as members of our Board of Directors requires the affirmative vote of a quorum isplurality of the shares of common stock present, directorsin person, or represented by proxy at the Annual Meeting. “Plurality” means that the individuals who receive the largest number of votes are elected as directors, up to the maximum number of directors to be chosen. As a result, abstentions and broker non-votes will have no effect on this proposal. Approval of our proposal to approve a non-binding resolution regarding the compensation of our named executive officers requires a majority of the votes cast at the Annual Meeting. Accordingly, abstention and broker non-vote will not count as a vote in favor of or against this proposal. The proposal to amend our Artic les of Incorporation to increase our authorized common stock requires the approval of a majority of the shares present at the Annual Meeting, in person or by plurality. With respect toproxy. As a result, abstentions and broker non-votes will count as votes against such proposal. Each of these proposals was unanimously recommended by our Board of Directors. If any other proposal however, ifcomes before the BoardAnnual Meeting that has not been recommended it by a majority of our Continuing“Continuing Directors,” as defined in our Amended and Restated Articles of Incorporation (the “Articles of Incorporation”), then approval of any such

proposal requires the affirmative vote of at least 80% of the “Total Voting Power” of the Company, as defined in our Articles of Incorporation, then, generally, theIncorporation.

You may vote of a majorityyour shares by any one of the votes cast is requiredfollowing methods:

| · | By mail: Mark your votes, sign and return the proxy card or vote instruction form in the enclosed postage paid envelope. |

| · | By Internet: Log onto the website indicated on your enclosed proxy card or vote instruction form. |

| · | You may attend the Annual Meeting in person and use a ballot to cast your vote. |

If you vote by the Internet, you do not need to approve it, and if it is not so recommended, then thesend in your proxy card or vote of 80% of the Total Voting Power, as defined in the Articles, is required to approve it.instruction form. The Continuing Directors will appoint the Judge(s) of Election, and all questions as to voter qualification, proxy validity and accepting or rejecting votesdeadline for Internet voting will be decided by11:59 p.m., Central Time, on May 25, 2010. If your shares are held in street name, and you wish to vote your shares at the Judge(s).

AbstentionsAnnual Meeting, you will need to contact your bank, broker or broker non-votes will not have any effect onother nominee to obtain a legal proxy form that you must bring with you to the election of directors. On any other proposal, abstentions and broker non-votes will be counted as votes not cast and will have no effect on any proposal that needsmeeting to exchange for a majority of votes cast to approve it and will have the effect of a vote against any proposal that needs the vote of a percentage of the Total Voting Power.ballot.

All proxies received in the enclosed form will be voted as you specify. If you sign and return your proxy form but do not specify and, unless you specifyhow to the contrary,vote your shares, your shares will be voted for the election of the persons named herein, and for the resolution to approve our compensation resolution.resolution and for the amendment to our Articles of Incorporation. We do not know of anything else to be presented at the Meeting other than the election of directors, and approval of the non-binding advisory resolution, and amendment to our Articles of Incorporation, but if anything else does come up, the persons named in the enclosed proxy will vote the shares covered by the proxy as determined by the Board of Directors.

AYou have the right to change and revoke your proxy may be revoked by you at any time before its exercise by filing with our Secretary a written revocation or a duly executed proxy with a later date.the Annual Meeting. If you votehold your shares in person in a manner inconsistent with ayour name, you may contact our Corporate Secretary and request that another proxy card be sent to you. Alternatively, you may use the Internet to re-vote your shares, even if you mailed your proxy card or previously filedvoted using the Internet. The latest-dated, properly completed proxy that you submit, whether through the Internet or by mail will count as your vote. Please note that if you youre-vote your shares by mail, your re-vote will not be deemed to have revokedeffective unless it is received by our Corporate Secretary at the proxy asaddress specified herein prior to the mattersAnnual Meeting. If your shares are held in street name, you voted on in person.must contact your broker or other nominee and follow its procedures for changing your vo te.

The cost of soliciting proxies will be borne by us. In addition to the mail, proxies may be solicited by our directors and officers through personal interview, telephone, telegraph, facsimile, internetInternet and e-mail. Banks, brokerage houses and other nominees or fiduciaries may be asked to forward these materials to their principals and to get authority to execute proxies, and we will, upon request, reimburse them for their expenses in so acting.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY

MATERIALS FOR OUR ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 26, 2010.

Our Proxy Statement for the 2010 Annual Meeting and our Annual Report to shareholders for the year ended December 31, 2009 is available at https://bnymellon.mobular.net/bnymellon/msl.

ANNUAL MEETING BUSINESS

Item 1.Election1. Election of Directors

Our Articles of Incorporation provide for three classes of directors, with one class to be elected at each annual meeting for a three-year term. At the Annual Meeting, three Class III Directors will be elected to serve until the 20122013 annual meeting.meeting or their earlier resignation, removal or death and until their successors are elected and qualified.

Unless you withhold authority, the persons named in the enclosed proxy will vote the shares covered by the proxies received by them for the electionre-election of the fourthree Class III director nominees named below. If for some reason one or more nominees can not be a candidaterefuse to stand for re-election at the Annual Meeting, the shares will be voted in favor of such other persons as the Board chooses. Directors will be elected by plurality vote.

Other than the Board, only shareholders who have complied with the procedures of Article IV (H) of our Articles of Incorporation may nominate a person for election. To do so, you must have given us written notice by January 15, 2009,the applicable date, of the following:

(1) as to each person whom you propose to nominate:

(a) his or her name, age, business address, residence address, principal occupation or employment,

(b) the number of shares of our stock of which the person is the beneficial owner and

(c) any other information relating to the person that would be required to be disclosed in solicitations of proxies for the election of directors by Regulation 14A under the Securities Exchange Act of 1934; and

(2) as to you:

(a) your name and address,

(b) the number of shares of our Stockstock of which you are the beneficial owner and

(c) a description of any agreements, arrangements or relationships between you and each personeachperson you want to nominate.

Two inspectors,An inspector, not affiliated with us, appointed by our Secretary, will determine whether the notice provisions were met; ifmet. If they determine that you have not complied with Article IV(H)IV (H), your nomination will be disregarded. No shareholder nominations for director were received in connection with this Annual Meeting.

The following table gives information as of March 31, 2009,2010, about each director nominee and each other director.current director, including information regarding why we believe such person should serve as a director of the Company. Unless otherwise indicated, each person has had the principal occupation shown for at least the past five years.

YOUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF ALL NOMINEES.

| Directors Nominees for terms to expire in 2013 (Class II Directors) |

| Name | Age | Principal Occupation | Year First Became Director |

| Will Charbonnet, Sr. | 62 | Our Chairman of the Board; Treasurer and Managing Director of Crossroads Catholic Bookstore (non-profit corporation); Controller of Philadelphia Fresh Foods, L.L.C. Mr. Charbonnet’s financial expertise, business experience and strong analytical skills are helpful to the Board’s ability to direct the affairs of a highly regulated company. | 1984 |

| Clayton Paul Hilliard | 84 | President of Badger Oil Corporation, Convexx Oil and Gas, Inc., and Warlord Oil Corporation; Manager, Uniqard, L.L.C. Mr. Hilliard's experience as owner and President of an oil field service business provides the Board with insight into the oil and gas industry, which industry comprises a large portion of the Bank's customers. | 1984 |

| Joseph V. Tortorice, Jr. | 60 | C.E.O., Deli Management, Inc. Mr. Tortorice’s business experience as a successful entrepreneur and familiarity with the community are valuable in directing the affairs of the Company. | 2004 |

| Directors whose terms expire in 2011 (Class III Directors) |

| Name | Age | Principal Occupation | Year First Became Director |

| James R. Davis, Jr. | 57 | President, Davis/Wade Financial Services, L.L.C.; Chairman of our Audit Committee Mr. Davis’ professional experience as a successful entrepreneur provides the Board with business insight and analytical skills that are necessary to direct the Company’s affairs in this difficult and highly regulated environment. | 1991 |

| Karen L. Hail | 56 | Our Senior Executive Vice President and Director of Asset Procurement Ms. Hail’s experience in the banking industry, her involvement in various organizations, and her extensive contacts within the communities in which we operate are valuable to the Company. | 1988 |

| Milton B. Kidd, III, O.D. | 61 | Optometrist, Kidd & Associates, L.L.C. Dr. Kidd’s professional and entrepenuerial experience in addition to his business and family contacts in the banking community are assets to the Board. | 1996 |

Director Nominees for terms to expire in 2012 (Class I Directors)

| Name | | Age | | Principal Occupation | | Year First Became Director |

| | | | | | | | |

| C. R. Cloutier | | | 62 | | Our President and C.E.O., and President and C.E.O. of our subsidiary, MidSouth Bank, N.A. | | 1984 |

J. B. Hargroder, M.D. | | | 78 | | Physician, retired; Vice Chairman of our Board | | 1984 |

Timothy J. Lemoine | | | 58 | | Construction Consultant | | 2007 |

| William M. Simmons | | | 75 | | Investor | | 1984 |

| R. Glenn Pumpelly | 51 | President/C.E.O., Pumpelly Oil Company, L.L.C. Mr. Pumpelly’s professional experience as a successful owner of a petroleum marketing company as well as his involvement on various boards provides the Board with business insight and analytical skills that are necessary to direct the Company’s affairs in this difficult environment. | 2007 |

Directors whose terms expire in 2010 (Class II| Directors whose terms expire in 2012 (Class I Directors) |

Name | | Age | | Principal Occupation | | Year First Became Director |

| | | | | | | |

| Will Charbonnet, Sr. | | | 61 | | Our Chairman of the Board; Treasurer and Managing Director of Crossroads Catholic Bookstore (non-profit corporation); Controller of Philadelphia Fresh Foods, L.L.C. | | 1984 |

| Clayton Paul Hilliard | | | 83 | | President of Badger Oil Corporation, Convexx Oil and Gas, Inc., and Warlord Oil Corporation; Manager, Uniqard, L.L.C. | | 1984 |

| Joseph V. Tortorice, Jr. | | | 59 | | C.E.O., Deli Management, Inc. | | 2004 |

| Name | Age | Principal Occupation | Year First Became Director |

| C. R. Cloutier | 63 | Our President and C.E.O., and President and C.E.O. of our subsidiary, MidSouth Bank, N.A. Mr. Cloutier’s experience in the banking industry, service on the Federal Reserve Board, and his extensive contacts and involvement within the communities in which we operate and on the national scene are valuable to leading the Board through the current economic environment. | 1984 |

J. B. Hargroder, M.D. | 79 | Physician, Retired; Vice Chairman of our Board Dr. Hargroders’ business experience in the medical field, his grasp in dealing with government regulations, and his familiarity with his community are assets to the board. | 1984 |

Timothy J. Lemoine | 59 | Construction Consultant Mr. Lemoine’s vast business experience and considerable knowledge of the construction industry are critical to providing insight to the Company. | 2007 |

| William M. Simmons | 76 | Investor, Retired Mr. Simmon’s entrepreneurial experience and business combined with his family contacts within the communities in which we operate are invaluable to the Company. | 1984 |

Directors whose terms expire in 2011 (Class III Directors)

| Name | | Age | | Principal Occupation | | Year First Became Director |

| | | | | | | | |

| James R. Davis, Jr. | | | 56 | | President, Davis/Wade Financial Services, L.L.C.; Chairman of our Audit Committee and our Lead Director | | 1991 |

| Karen L. Hail | | | 55 | | Our Senior Executive Vice President and Chief Operating Officer and of our subsidiary, MidSouth Bank, N.A. | | 1988 |

Milton B. Kidd, III, O.D. | | | 60 | | Optometrist, Kidd & Associates, L.L.C. | | 1996 |

| R. Glenn Pumpelly | | | 50 | | President/C.E.O. Pumpelly Oil Company, L.L.C. | | 2007 |

Item 2.Proposal2. Proposal to Approve a Non-binding Advisory Resolution on the CompensationofCompensation of our Named Executive Officers

As a result of our participation in the Capital Purchase Program (the “CPP”) of the U.S. Department of the Treasury’s Troubled Asset Relief Program we are subject to the provisions of the Emergency Economic Stabilization Act of 2008 (“EESA”), which was recently amended by the American Recovery and Reinvestment Act of 2009 (ARRA)(“ARRA”) to provide additional executive compensation requirements.

Per the additional requirements defined by the ARRA, we submit to our shareholders a non-binding resolution to approve the compensation of our named executive officers (the “Named Executive Officers” or “NEOs”), as disclosed in this Proxy Statement, including the Compensation Discussion and Analysis, the executive compensation tables and anythe other related disclosure. Shareholders are encouraged to carefully review the executive compensation sections of this Proxy Statement outlining the Company’s executive compensation program. Accordingly, the Board of Directors hereby submits for shareholder consideration, the resolution set forth below, commonly known as a “say-on-pay proposal,”

“Resolved, that the shareholders hereby approve the compensation of our named executive officers as reflected in the proxy statementProxy Statement for the meetingAnnual Meeting and as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission, which disclosure includes the Compensation Discussion and Analysis, the compensation tables and all related materials."material in the Proxy Statement.”

The Board of Directors believes that the Company'sCompany’s compensation policies and procedures are centered on a pay-for-performance culture and are strongly aligned with the long-term interests of shareholders, and, accordingly, recommends a vote in favor of this resolution.

If this resolution is not approved by our shareholders, such a vote shall not be construed as overruling a decision by the Board of Directors or Personnel Committee of the Board, nor create or imply any additional fiduciary duty by the Board of Directors or the Personnel Committee, nor shall such a vote be construed to restrict or limit the ability of our shareholders to make proposals for inclusion in proxy materials related to executive compensation. Notwithstanding the foregoing, the Board of Directors and the Personnel Committee will consider the non-binding vote of our shareholders on this resolution when reviewing compensation policies and practices in the future.

YOUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE PROPOSED RESOLUTION ON THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS.

Item 3. Proposal to Amend our Amended and Restated Articles of Incorporation to Increase the Number of Authorized Shares of our Common Stock, $0.10 Par Value Per Share, from 10,000,000 Shares to 30,000,000 Shares

Background

Our Board of Directors is requesting shareholder approval of an amendment to our Articles of Incorporation to increase our authorized number of shares of common stock from 10,000,000 shares to 30,000,000 shares. This proposal would amend subpart A of Article III of the Articles of Incorporation to read in its entirety as follows with respect to total shares of capital stock authorized:

“A. Authorized Stock. The Corporation shall have the authority to issue 35,000,000 shares of capital stock, of which 30,000,000 shares shall be Common Stock, $0.10 par value per share, and 5,000,000 shares shall be Preferred Stock, no par value per share.”

As of March 31, 2010, there were 9,873,744 shares of common stock issued, and 9,723,267 shares outstanding. In addition, we had 61,368 shares reserved for issuance upon the exercise of outstanding equity incentive awards and 104,384 shares reserved for issuance upon conversion of the warrants held by the U.S. Department of the Treasury (the “Treasury”) that we issued as part of our participation in the CPP. Accordingly, we have only approximately 111,000 shares of common stock currently available for future issuances.

Under Louisiana law, we may issue shares of common stock only to the extent such shares have been authorized for issuance under our Articles of Incorporation. The additional common stock to be authorized by adoption of this proposed amendment would have rights identical to our currently authorized and outstanding common stock. Adoption of the proposed amendment and issuance of any additional shares of common stock would not affect the rights of the holders of our currently outstanding common stock, except for effects incidental to increasing the number of shares of our common stock outstanding, such as dilution of the voting rights of current shareholders.

Purpose and Effect of the Increase in the Amount of Our Authorized Common Stock

Our Board of Directors believes it is desirable to have additional shares of common stock available to provide additional flexibility to use our capital stock for business and financial purposes in the future.

The additional shares may be used for various purposes without further shareholder approval, subject to applicable laws and NYSE AMEX listing requirements that may require shareholder approval for certain issuances of additional shares. These purposes may include: raising capital; establishing strategic relationships with other companies; expanding our business through acquisitions; providing equity incentives to our employees and directors; and other purposes. With so few authorized but unissued shares currently available, the Board is currently limited in its ability to pursue additional capital raises that could be used to further increase our capital position to take advantage of strategic opportunities. In order to allow for sufficient shares for our public stock offering completed in December 2009 , the Board of Directors suspended any additional grants under our 2007 Omnibus Incentive Plan (the “Incentive Plan”) and released shares previously reserved under the Incentive Plan for distribution in the offering. The Board of Directors does not anticipate lifting the suspension of grants under the Incentive Plan until the amendment to increase our authorized common stock is approved. As a result, unless the amendment is approved, the Board’s ability to make equity incentive grants to our officers and employees will be extremely limited, which could make it more difficult for us to recruit and retain personnel. As a result, the Board of Directors has determined that the proposed amendment to the Articles of Incorporation is desirable and in its shareholders’ best interest.

If the amendment is approved, we expect that the Board will lift the suspension it imposed on grants under the Incentive Plan and will issue awards to our officers and employees, although no awards have been made as of the date of this Proxy Statement. Other than the anticipated grant of any such awards, shares of common stock currently reserved for issuance under our existing equity incentive plans and upon conversion of our outstanding warrants held by the Treasury, we currently do not have any plans or arrangements to issue additional shares of common stock.

If approved by shareholders at the Annual Meeting, the amendment to increase our authorized common stock will become effective upon the filing of Articles of Amendment to our Articles of Incorporation with the Louisiana Secretary of State, which such filing we expect to make promptly after approval of our shareholders at the Annual Meeting.

YOUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE PROPOSAL TO AMEND OUR ARTICLES OF INCORPORATION TO INCREASE OUR AUTHORIZED COMMON STOCK.

Item 3.Such4. Such other matters as may properly come before the meeting or any adjournments

The Board of Directors knows of no other matters to be brought before the shareholders at the meeting. If other matters are presented for a vote at the meeting, the proxy holders will vote shares represented by properly executed proxies as directed by the Board of Directors. At the meeting, management will report on our business and shareholders will have the opportunity to ask questions.

Corporate Governance

Shareholder, Board and Committee Meetings. During 20082009 the Board of Directors had twelve12 meetings, and each director attended at least 75% of the total number of meetings held of the Board and committees of which he or she was a member. While we encourage all Board members to come to annual shareholder meetings, there is no formal policy as to their attendance. It is a rare occasion, however, when all members are not there.All of our directors attended the 2009 Annual Meeting.

Board Independence. Each year, our Corporate Governance and Nominating Committee reviewsreview the relationships that each director has with us and with other parties. Only those directors who do not have any relationships that keep them from being independent within the meaning of applicable NYSE Amex rules and who the Committee finds have no relationships that would interfere with the exercise of independent judgment in carrying out their responsibilities are considered to be “independent directors.” The Committee reviews a number of factors to evaluate independence, including the directors’ relationships with us and our competitors, suppliers and customers; their relationships with management and other directors; the relationships their current and former employers have with us; and the relationships between us and other companies of which they are directors or executive officers. After evaluating these factors, the Board determined that Messrs. Charbonnet, Davis, Hargroder, Hilliard, Kidd, Lemoine, Pumpelly, Simmons and Tortorice are independent within the meaning of applicable NYSE Amex and SEC rules.

Leadership Structure and Risk Management. The Board believes that our leadership structure, with separate persons serving as our Chairman of the Board and CEO, is in the best interests of our shareholders at this time. We believe this structure recognizes the differences between the two roles. Our CEO is responsible for setting the strategic direction for the Company and the day-to-day leadership and performance of the Company, while our Chairman of the Board provides guidance to our CEO and sets the agenda and presides over meetings of the full Board of Directors. We believe that the role of a separate Chairman, who is also an outside director, also helps enhance the independent oversight of management of the Company and helps to ensur e that the Board is fully engaged with the Company’s strategy and how well it is being implemented.

In addition to the roles outlined above, the Board takes an active role in overseeing the management, operations, risk and soundness of the Company. The Chairman of the Board and the Audit Committee Chairman serve as voting members of the Special Asset Committee. In addition, the Chairman of the Company’s Audit Committee also chairs the Company’s Risk Committee. The Risk Committee assures that the Company and the Bank maintain an effective system for identifying, measuring, monitoring, and controlling entity wide risk. The Committee also provides for the oversight of the quality and integrity of accounting, financial reporting, risk management, and control practices of the Company. We believe that such active Board participation strengthens the Company’s operations.

Shareholder Communications. Shareholders may communicate directly with the Board or the individual chairmen of committees by writing directly to them at P. O. Box 3745, Lafayette, LA 70502. We will forward, and not screen, any mail we receive that is directed to an individual, unless we believe the communication may pose a security risk.

Code of Ethics. The Board has adopted a Code of Ethics for our directors, officers and employees to promote honest and ethical conduct, full and accurate reporting, and compliance with laws as well as other matters. A copy of the Code of Ethics is posted on the CorporateInvestor Relations page of our website at www.midsouthbank.com. A printed copy of our Code of Ethics is available to any shareholder that requests it in writing from our Corporate Secretary.

Standing Board Committees. The Board has an Audit Committee, an Executive Committee, a Personnel Committee, and a Corporate Governance and Nominating Committee. Each of these committees operates pursuant to a charter. The charters are available on the Investor Relations page of our website at www.midsouthbank.com. A printed copy of each charter is also available to any shareholder that requests it in writing from our Corporate Secretary.

Audit Committee. The responsibilities of the Audit Committee members are Messrs. Davis, Charbonnet, Hilliard, and Kidd and held ten meetingsset forth in 2008. It is responsible for carrying out theour Audit Committee Charter. The Board has made a determination that its members satisfy NYSE Amex’s requirements as to independence, financial literacy and experience. The Board has also determined that it is not clear whether any member of the Audit Committee is a “Financial Expert” within the meaning of SEC Rules, but the Board does not feel a Financial Expert necessary in view of the overall financial sophistication of the Audit Committee members.

Executive Committee. The responsibilities of the Executive Committee members are Messrs. Charbonnet, Cloutier, Hargroder, Pumpelly, and Tortorice and met ten timesset forth in 2008.our Executive Committee Charter. Its duties include shareholder relations, Bank examination and Securities and Exchange Commission (“SEC”)SEC reporting.

Personnel Committee. The responsibilities of the Personnel Committee members are Messrs. Charbonnet, Davis, Hargroder, and Tortorice and met four timesset forth in 2008.our Personnel Committee Charter. It is responsible for evaluating the performance and setting/approving the compensation of our executive officers and administering our 2007 Omnibus Incentive Compensation Plan.

Corporate Governance and Nominating Committee. The responsibilities of the Corporate Governance and Nominating Committee members are Messrs. Charbonnet, Hargroder, Hilliardset forth in our Corporate Governance and Simmons and met once in 2008.Nominating

Committee Charter. It helps the Board to make determinations of director independence, assess overall and individual Board performance and recommend director candidates, including recommendations submitted by shareholders.

-7-The following chart details the composition of the Board and its committees and also includes the number of meetings held by each group in 2009:

| Director | Independent Director | Holding Company Board | Bank Board | Committees of the Board |

| Audit | Personnel | Exec | Corp Gov & Nom |

| Will Charbonnet Sr. | Yes | Chair | Chair | Member | Chair | Chair | Member |

| James R. Davis Jr. | Yes | Member | Member | Chair | Member | | |

| J.B. Hargroder, M.D. | Yes | Vice-Chair | Vice-Chair | | Member | Member | Chair |

| Clayton Paul Hilliard | Yes | Member | Member | Member | | | Member |

| Milton B. Kidd III, O.D. | Yes | Member | Member | Member | | | |

| Timothy J. Lemoine | Yes | Member | Member | | | | |

| R. Glenn Pumpelly | Yes | Member | Member | | Member | Member | |

| William M. Simmons | Yes | Member | Member | | | | Member |

| Joseph V. Tortorice, Jr. | Yes | Member | Member | | Member | Member | |

| C.R. Cloutier | No | Member | Member | | | Member | |

| Karen L. Hail | No | Member | Member | | | | |

| Total Members as of 12/31/2009 | 11 | 11 | 4 | 5 | 5 | 4 |

| Number of Meetings Held in 2009 | 12 | 11 | 9 | 7 | 12 | 2 |

Director Nominations.It is the Corporate Governance and Nominating Committee’s policy that candidates for director have the highest personal and professional integrity, have demonstrated exceptional ability and judgment, and have skills and expertise appropriate for serving the long-term interest of our shareholders. While we have not adopted a diversity policy with respect to the composition of our Board, the Corporate Governance and Nominating Committee seeks directors who will contribute to the diversity of the Board (including diversity of skills, background, and experience) in order to help enhance the quality of the Board’s deliberations and decisions. The Committee’s process for identifying and evaluating nominees is as follows:f ollows: (1) in the case of incumbent directors whose terms of office are set to expire, the Committee reviews their overall service during their terms, including the number of meetings attended, level of participation, quality of performance, and any related party transactions with us during the applicable time period; and (2) in the case of new director candidates, appropriate inquiries into their backgrounds and qualifications are made after considering the function and needs of the Board. The Committee meets to discuss and consider such candidates’ qualifications, including whether the nominee is independent within the meaning of NYSE Amex rules, and then selects a candidate for recommendation to the Board. In seeking potential nominees, the Committee uses its and management’s network of contacts to compile a list of potential candidates, but may also engage, if it deems appropriate, a professional search firm, although to date it has not done so.

The Committee will consider director candidates recommended by shareholders who follow the procedures set out in Article IV (H) of our Articles described elsewhere.under “Item 1. Election of Directors” in this Proxy Statement. It does not intend to alter the manner in which it evaluates candidates, including the criteria set forth above, based on whether the candidate was recommended by a shareholder or otherwise.

Shareholder Proposals.Eligible shareholders who want to present a proposal qualified for inclusion in our proxy materials for the 2010 annual meeting2011 Annual Meeting must forward such proposal to our Secretary at the address listed on the first page of this Proxy Statement in time to arrive before December 22, 2009.24, 2010. Proxies may confer discretionary authority to vote on any matter for which we receive notice after March 9, 2011, without the matter being described in the Proxy Statement for our 2011 Annual Meeting.

Section 16(a) Beneficial Ownership Reporting Compliance.The Securities and Exchange Act of 1934 and applicable SEC regulations require our directors, executive officers and ten percent shareholders to file with the SEC initial reports of ownership and reports of changes in ownership of our equity securities, and to furnish us with copies of all the reports they file. To our knowledge, based on a review of reports given us, all required reports were filed timely.timely except for one incident each by Joseph V. Tortorice, Jr. and James R. McLemore in filing of Form 4.

Personnel Committee Interlocks and Insider Participation. The Personnel Committee is composed entirely of independent directors. None of our executive officers has served on the board of directors or compensation committee (or other committee serving an equivalent function) of any other entity, none of whose executive officers served on our Board of Directors or Personnel Committee. None of the members of the Personnel Committee was an officer or other employee of our Company or any of our subsidiaries during 2009, or is a former officer or other employee of our Company or any of our subsidiaries.

___________________

SECURITY OWNERSHIP OF MANAGEMENT

AND CERTAIN BENEFICIAL OWNERS

Security Ownership of Management

The following table shows as of March 31, 2009,2010, the beneficial ownership of our Stockcommon stock by each director and nominee, by each executive officer named in the Summary of Executive Compensation Table below, and by all directors and executive officers as a group. Unless otherwise indicated, the Stockstock is held with sole voting and investment power.

| Name | | Amount and Nature of Beneficial Ownership(1) | | | Percent of Class | |

| Will Charbonnet, Sr. | | | 167,747 | (1,2) | | | 1.73 | % |

| C. R. Cloutier | | | 408,392 | (1,3) | | | 4.19 | % |

| James R. Davis, Jr. | | | 77,264 | (4) | | | 0.79 | % |

| Karen L. Hail | | | 111,385 | (5) | | | 1.15 | % |

| J. B. Hargroder, M.D. | | | 451,408 | (1,6) | | | 4.64 | % |

| Clayton Paul Hilliard | | | 252,079 | (7) | | | 2.59 | % |

| Milton B. Kidd, III, O.D. | | | 242,804 | | | | 2.50 | % |

| Timothy J. Lemoine | | | 28,165 | (8) | | | 0.29 | % |

| R. Glenn Pumpelly | | | 22,279 | (1,9) | | | 0.23 | % |

| William M. Simmons | | | 221,228 | (10) | | | 2.28 | % |

| Joseph V. Tortorice, Jr. | | | 113,139 | (1,11) | | | 1.16 | % |

| J. Eustis Corrigan, Jr. | | | 5,748 | (12) | | | 0.06 | % |

| Donald R. Landry | | | 94,744 | (13) | | | 0.97 | % |

| James R. McLemore | | | 1,000 | (14) | | | 0.01 | % |

| Teri S. Stelly | | | 26,040 | | | | 0.27 | % |

| A. Dwight Utz | | | 2,913 | (15) | | | 0.03 | % |

All directors and executive officers as a group (16 persons) | | | 2,238,492 | (16) | | | 22.96 | % |

| Name | | Amount and Nature of Beneficial Ownership(1) | | | Percent of Class | |

| Will Charbonnet, Sr. | | | 162,559 | (1,2) | | | 2.39 | % |

| C. R. Cloutier | | | 405,499 | (1,3) | | | 5.95 | % |

| James R. Davis, Jr. | | | 76,325 | (4) | | | 1.12 | % |

| Karen L. Hail | | | 108,588 | (5) | | | 1.60 | % |

| J. B. Hargroder, M.D. | | | 450,131 | (1,6) | | | 6.63 | % |

| Clayton Paul Hilliard | | | 251,539 | (7) | | | 3.71 | % |

| Milton B. Kidd, III, O.D. | | | 242,378 | | | | 3.57 | % |

| Timothy J. Lemoine | | | 27,995 | (8) | | | .41 | % |

| R. Glenn Pumpelly | | | 17,279 | | | | .23 | % |

| William M. Simmons | | | 217,463 | (9) | | | 3.20 | % |

| Joseph V. Tortorice, Jr. | | | 98,313 | | | | 1.45 | % |

| J. Eustis Corrigan, Jr. | | | 14,325 | (10) | | | .21 | % |

| Donald R. Landry | | | 93,572 | (11) | | | 1.38 | % |

| Teri S. Stelly | | | 25,223 | (12) | | | .37 | % |

| A. Dwight Utz | | | 5,250 | (13) | | | .07 | % |

All directors and executive officers as a group (15 persons) | | | 2,208,317 | | | | 32.35 | % |

_______________

| (1) | Stock held by our Directors'Directors’ Deferred Compensation Plan & Trust (the “Trust”“DDCP”) is beneficially owned by its Plan Administrator, our Executive Committee, the members of which could be deemed to share beneficial ownership of all Stock held in the Trust (360,426DDCP (370,857 shares or 5.31%3.81% as of March 31, 2009)2010). For each director, the table includes the number of shares held for his or her account only, while the group figure includes all shares held in the Trust.DDCP. Stock held by our Employee Stock Ownership Plan (the “ESOP”) is not included in the table, except that shares allocated to an individual'sindividual’s account are included as beneficially owned by that individual. Shares which may be acquired by exercise of currently exercisable options (“Current Options”) are deemed outstanding for purposes of computing the percentage of outstandingoutst anding Stock owned by persons beneficially owning such shares and by all directors and executive officers as a group but are not otherwise deemed to be outstanding. |

| (2) | Includes 47,82651,826 shares as to which he shares voting and investment power. |

| (3) | Includes 226,527 shares as to which he shares voting and investment power. Mr. Cloutier's address is P. O. Box 3745, Lafayette, Louisiana 70502.Cloutier and his wife, Brenda Cloutier, have pledged 15,000 shares to Whitney Bank securing a loan in the amount of $300,000 with a balance of $220,174 for their daughter’s daycare business. Additionally, Mr. and Mrs. Cloutier have pledged 6,979 shares to First National Banker’s Bank to secure a personal loan in the amount of $140,045 with a balance of $73,081. |

| (4) | Includes 8,998 shares as to which he shares voting and investment power. Mr. Davis has pledged 27,375 shares to Capital One Investments to secure a $250,000 line of credit with a balance of $230,000 as well as a securing a $159,658 loan with a balance of $148,100. |

| (5) | Includes 1,244 shares as to which she shares voting and investment power. |

| (6) | Includes 395,800 shares as to which he shares voting and investment power. Dr. Hargroder's address is P. O. Box 1049, Jennings, Louisiana 70546. |

| (7) | Includes 120,303 shares as to which he shares voting and investment power. Mr. Hilliard has pledged 43,672 shares to MidSouth Bank as partial security on a $1,000,000 line of credit with a balance of $0.00. Additionally, Mr. Hilliard has 15,200 shares in his Morgan Stanley account which serves as collateral for his UBS Line of Credit which has an outstanding balance of $604,221. |

| (8) | Includes 20,70020,733 shares as to which he shares voting and investment power. |

| (9) | Includes 7,82522,279 shares as to which he shares voting and investment power. |

| (10) | Includes 5,7198,365 shares as to which he shares voting and investment power. |

| (11) | Includes 38,08295,985 shares as to which he shares voting and investment power. |

| (12) | Includes 21,6585,448 shares as to which shehe shares voting and investment power. |

| (13) | Includes 1,55538,082 shares as to which he shares voting and investment power. |

| (14) | Includes 1,000 shares as to which he shares voting and investment power. |

| (15) | Includes 55 shares as to which he shares voting and investment power. |

| (16) | Total reflects 12,157 shares held in Director’s Deferred Compensation Plan & Trust for the benefit of a former director who has not yet received a distribution. |

_______________________

The following table shows the number of shares in the TrustDDCP (see footnote 1 above) and ESOP, and the number of shares subject to Current Options, (options that the named person may exercise in 60 days) that have been included in the above ownership table.

| Name | | Trust | | | ESOP | | | Current Options | | | DDCP | | | ESOP | | | Current Options | |

| Will Charbonnet, Sr. | | | 50,521 | | | | -- | | | | -- | | | | 51,709 | | | | -- | | | | -- | |

| C. R. Cloutier | | | 61,519 | | | | 31,664 | | | | 24,816 | | | | 62,966 | | | | 33,110 | | | | 24,816 | |

| James R. Davis, Jr. | | | 39,954 | | | | -- | | | | -- | | | | 40,893 | | | | -- | | | | -- | |

| Karen L. Hail | | | 39,455 | | | | 54,862 | | | | -- | | | | 40,383 | | | | 56,731 | | | | -- | |

| J. B. Hargroder, M.D. | | | 54,331 | | | | -- | | | | -- | | | | 55,608 | | | | -- | | | | -- | |

| Clayton Paul Hilliard | | | 22,977 | | | | -- | | | | -- | | | | 23,517 | | | | -- | | | | -- | |

| Milton B. Kidd, III, O.D. | | | 18,123 | | | | -- | | | | -- | | | | 18,549 | | | | -- | | | | -- | |

| Timothy J. Lemoine | | | 7,262 | | | | -- | | | | -- | | | | 7,432 | | | | -- | | | | -- | |

| R. Glenn Pumpelly | | | -- | | | | -- | | | | -- | | | | -- | | | | -- | | | | -- | |

| William M. Simmons | | | 52,078 | | | | -- | | | | -- | | | | 53,303 | | | | -- | | | | -- | |

| Joseph V. Tortorice, Jr. | | | 2,328 | | | | -- | | | | -- | | | | 4,340 | | | | -- | | | | -- | |

| J. Eustis Corrigan, Jr. | | | -- | | | | 731 | | | | 7,875 | | | | -- | | | | 300 | | | | 0 | |

| Donald R. Landry | | | -- | | | | 26,397 | | | | -- | | | | -- | | | | 27,569 | | | | -- | |

| James R. McLemore | | | | -- | | | | 0 | | | | -- | |

| Teri S. Stelly | | | -- | | | | 21,658 | | | | 2,888 | | | | -- | | | | 22,475 | | | | 2,888 | |

| A. Dwight Utz | | | -- | | | | 2,792 | | | | 903 | | | | -- | | | | 2,858 | | | | 0 | |

_______________________

Security Ownership of Certain Beneficial Owners

The following lists as of March 31, 2009,2010, the only persons other than the persons listed in the table above known to us to beneficially own more than five percent of our Stock.

Name and Address Of Beneficial Owner | | Shares Beneficially Owned | | | Percent of Class | |

MidSouth Bancorp, Inc., Employee Stock Ownership Plan, ESOP Trustees and ESOP Administrative Committee P. O. Box 3745, Lafayette, LA 70502 | | | 570,807 | (1) | | | 5.88 | % |

| | | | | | | | | |

Sandler O’Neill Asset Management, LLC(2) 780 Third Avenue, 5th Floor New York, New York 10017 | | | 554,900 | | | | 5.71 | % |

| | | | | | | | | |

Jacobs Asset Management, LLC(3) One Fifth Avenue New York, New York 10003 | | | 585,408 | | | | 6.02 | % |

| | | | | | | | | |

Stichting Pensioenfonds ABP(4) Oude Lindestraat 70 Postbus 2889, 6401 DL Heerlen The Kingdom of the Netherlands | | | 581,900 | | | | 5.98 | % |

Name and Address Of Beneficial Owner | Shares Beneficially Owned | Percent of Class |

| | | |

MidSouth Bancorp, Inc., Employee Stock Ownership Plan, ESOP Trustees and ESOP Administrative Committee P. O. Box 3745, Lafayette, LA 70502 | 558,337(1) | 8.22% |

| | | |

MidSouth Bancorp, Inc., (2) Directors Deferred Compensation Plan, Executive Committee P. O. Box 3745, Lafayette, LA 70502 | 360,426 | 5.31% |

___________________

(1) | The Administrative Committee directs the Trustees how to vote the approximately 30,82819,561 unallocated shares in the ESOP as of March 31, 2009.2010. Voting rights of the shares allocated to ESOP participants'participants’ accounts are passed through to them. The Trustees have investment power with respect to the ESOP'sESOP’s assets, but must exercise it in accordance with an investment policy established by the Administrative Committee. The Trustees are Donald R. Landry, an executive officer,Irving Boudreaux, a Regional President, and Katherine GardnerBernie Parnell and Brenda Jordan,Susan Benoit, two Bank employees. The Administrative Committee consists of employee Polly Leonardtwo Bank employees Marla Napier and Teri S. Stelly, an executive officer.Monique Bradberry and Susan Davis, a Senior Accounting Supervisor. |

(2) | Based on a Schedule 13D/A filed on March 11, 2010. |

(2) | See Note (1) to the Table of Security Ownership of Management.Based on a Schedule 13G filed on December 28, 2009. |

(4) | Based on a Schedule 13G filed on February 16, 2010. |

_________________________

Certain Relationships and Related Transactions

Directors, nominees, executive officers and their associates have been customers of, and have borrowed from MidSouth Bank in the ordinary course of business, and such transactions are expected to continue in the future. InAny loans or other extensions of credit made by the opinionBank to such individuals were made in the ordinary course of management, our loan policy is less favorable tobusiness on substantially the same terms, including interest rates and collateral, as those personsprevailing at the time for comparable transactions with unaffiliated third parties and did not involve more than tothe normal risk of collectability or present other customers.unfavorable features.

C. R. CloutierWe do not have a formal policy with respect to the approval of related party transactions, other than our policies with respect to the approval of loans made to directors and his wife, Brenda Cloutier,executive officers. However, it is expected that an appropriate committee of the board that is comprised of independent directors will review and, if appropriate, approve any transaction in which the Company is or will be a party and the amount exceeds $120,000, and in which any of the Company’s directors, executive officers or significant shareholders had, has or will have pledged 15,000 shares of our Stocka material interest. Such transactions will only be approved if they are deemed to Whitney Bank securing a loanbe in the amountbest interest of $284,000 with a balance of $241,275 for their daughter's daycare business. Additionally, Mr.the Company and Mrs. Cloutier have pledged 6,979 shares of our Stock to First National Banker's Bank to secure a personal loan in the amount of $140,000 with a balance of $93,000.its shareholders.

James R. Davis has pledged 27,355 shares of our Stock to Capital One Investments to secure a $250,000 line of credit with a balance of $200,000.

C. P. Hilliard has pledged 43,572 shares of our Stock to MidSouth Bank as partial security on a $1,000,000 line of credit with a balance of $0.00. Additionally, Mr. Hilliard has 15,200 shares of our Stock in his UBS account which serves as collateral for his UBS Line of Credit. The balance outstanding is $200,000._________________________

EXECUTIVE COMPENSATION

COMPENSATION DISCUSSION AND ANALYSIS

The following Compensation Discussion and Analysis may contain statements regarding future individual and Company performance targets or goals. We have disclosed these targets or goals in the limited context of our compensation programs and, therefore, you should not take these statements to be management’s expectations or estimates of results or other guidance. We specifically caution investors not to apply such statements to other contexts.

This Compensation Discussion and Analysis is intended to assist you in understanding our compensation programs. It is intended to explain the philosophy underlying our compensation strategy and the fundamental elements of compensation paid to our Chief Executive Officer, Chief Financial Officer, and other individuals included in the Summary Compensation Table (“Named Executive Officers”) for 2008. Specifically, this2009.

Objectives of Our Compensation Discussion and Analysis addresses the following:Programs

· | Objectives of our compensation programs; |

· | What our compensation programs are designed to reward; |

· | Process for determining executive officer compensation; |

· | Elements of compensation provided to our executive officers; |

–

| The purpose of each element of compensation |

–

| Why we elect to pay each element of compensation |

–

| How each element and our decisions regarding its payment relate to our goals |

· | Other important compensation policies affecting our executive officers. |

During 2008, the Bank completed a restructuring process to meet the demands and changes of the business brought on by the Bank's rapid growth and increase in size. The process impacted the implementation of changes in Named Executive Officer compensation, such as changes in base salary levels, as well as the allocation of various compensation elements to these employees.

Additionally, 2008 was a difficult year with turmoil throughout the economy and the financial services sector. The exceptionally difficult market conditions led to the Treasury’s creation of the Capital Purchase Program (CPP) under the Troubled Asset Relief Program (TARP). The program provided the opportunity for MidSouth Bancorp, Inc. to benefit from additional capital through sales of our preferred stock and common stock purchase warrants to the Treasury. We took part in the CPP, and on January 9, 2009 received $20,000,000 in funding. In February 2009, Congress passed the American Recover and Reinvestment Act of 2009 (ARRA), which placed additional rules upon executive compensation programs previously defined under CPP participation guidelines. We highlight the impact of all these events on the various elements of our executive compensation elements as we discuss our compensation programs throughout this document.

The Personnel Committee of the Board of Directors (“(the “Personnel Committee”) administers our executive compensation programs. During 2008, the Committee consisted of Will Charbonnet, Sr. (Chairman), James R. Davis, Jr., J. B. Hargroder, M.D., and Joseph V. Tortorice, Jr. The members of the Committee all qualify as independent, outside members of the Board in accordance with the requirements of the New York Stock Exchange (NYSE Amex), current SEC regulations and section 162(m) of the Internal Revenue Code.

Objectives of Our Compensation Programs

The Committee has the responsibility for continually monitoring the compensation paid to our Named Executive Officers (NEOs)(“NEOs”) as well as other executive employees. The Personnel Committee believes that compensation of our executive officers should encourage creation of stockholdershareholder value and achievement of strategic corporate objectives. Specifically, the Personnel Committee is committed to ensuring that the total compensation package for our executive officers will serve to:

| · | Attract, retain, and motivate outstanding executive officers whom add value to us based on individual and team contributions; |

| · | Provide a competitive salary structure in all markets where we operate; and |

| · | Align the executive officers’ interests with the long-term interests of our shareholders to enhance shareholder value. |

What Our

Impact of American Recovery and Reinvestment Act of 2009 on Executive Compensation Programs Are Designed to Reward

OurIn January 2009, the Company received $20 million in capital under the CPP. The CPP imposes restrictions on executive officers' compensation is designed to reward short as well as long-term performance. Our policy is to provide a large portion of compensation in cash, including an annual base salary and an opportunity to receive an annual incentive that is based on earnings per share (EPS). We provide this to keep the executive officers focused on current earnings and stability and to strongly align the executives with the interests of our shareholders. We also view the annual incentive as a long-term performance vehicle because we examine performance measures including credit quality, credit risk management, deposit growth, regulatory compliance, return on equity, and growth in our assets and income when assessing incentive grants to the executive officers. Credit quality, non accruals, and charge offswhich are impacted by long-term performance such that performancedetailed further in the current year affects these measures in future years.

Additionally, we have historically provided additional compensation benefits through our 1997 Stock Incentive Plan and our Employee Stock Ownership Plan (ESOP), which keeps the executive officers focused on our long-term goals.

Over the last several years, our performance has been above average as compared to similarly situated financial institutions, and the compensation programs are designed to reward and promote the continuation of this performance.narrative. We aim to provide a substantial portion of executive officers’ pay in the form of performance based compensation through the annual incentive opportunity. The impact of our focus on incentive compensation programs is clear in the reduction of overall pay levels in 2008 compared to 2007. Although we outperformed peers, our 2008 fiscal-year end EPS was lower than 2007 fiscal-year end levels.

Process for Determining Executive Officer Compensation

• Role of the Committee and the Executive Officers. The Committee annually reviews and recommends the levels, performance goals, and strategic objectives, relating to compensation of the Chief Executive Officer to our Board. Final approval on the Chief Executive Officer’s compensation is made by the full Board. The Committee also consults with the Chief Executive Officer on the compensation levels of the other executive officers. Based on these discussions, the Committee along with the Chief Executive Officer recommends the compensation levels for the other Named Executive Officers to the Board.

Additionally, the Committee periodically reviews our incentive plans and other equity based plans. The Committee reviews, adopts, and submits to the Board any proposed arrangement or plan and any amendment to an existing arrangement or plan that provides or will provide benefits to the executive officers collectively or to an individual executive officer. The Committee has sole authority to retain and terminate a compensation consultant or other advisor as the Committee deems appropriate.

• Role of the Compensation Consultant. During 2008, the Compensation Committee continued its engagement from 2007 with Amalfi Consulting LLC to assist with, and provide guidance on, executive and broad-based employee compensation programs. In making decisions regarding executive officer compensation for 2008, the Compensation Committee considered an overall compensation review completed for our top executive employees, including all of the five NEOs, by Amalfi Consulting in late 2007. We provide further details on the peer group created for this review under the “Benchmarking” section of this discussion.

The Committee also engaged Amalfi Consulting to assist with the design of an annual incentive plan structure to strengthen the alignment of the performance of plan participants with our goals and objectives. In addition to the annual incentive planning process, Amalfi Consulting LLC assisted us with the creation of an administrative plan document for its Phantom Stock incentive compensation program. Amalfi Consulting LLC reported directly to the Committee on all projects conducted and performed no other services for us in 2008.

• Benchmarking. To ensure the competitiveness of our total compensation package, the Committee uses salary survey information from several different nationally recognized surveys that focus on our industry and region. Specifically, we used salary survey information compiled by K G & Associates, including surveys from Watson Wyatt and Mercer. This information was used to evaluate what comparable institutions are paying. In 2008, K G & Associates conducted no other business with us. Along with the data compiled by K G & Associates, the Committee considered data from an additional compensation survey conducted by Scheshunoff Management Services.

In using survey data, we benchmark both base salary and annual incentive. Long-term incentives are not benchmarked because we feel that long-term incentives are not part of the basic compensation of the executive officers. Long-term incentives are viewed as an additional opportunity for the executive officer based on the value of our stock price.

In prior years our total compensation levels have been within the 50th to 75th percentile of survey market data from comparable organizations in the financial services industry. In light of the financial difficulties

and performance during 2008, and the impact of this performance on our incentive program payouts, we expect our total compensation levels are now below these market survey levels.

At the end of 2007 the Committee, in coordination with Amalfi Consulting LLC, conducted an overall review of the executive compensation program. As part of this review, a peer group of 20 banks comparable to us in terms of geographic location, asset size, growth and performance was selected. The criteria used to determine the peer group was based upon data as of fiscal year-end 2006. At the time of the peer group creation, we compared favorably to the peer group on 3-yr asset growth, return on average assets, and return on average equity. We present a summary of the 2006 comparison in the table below:

| | | Total Assets | | | Asset Growth | | | ROAA | | | ROAE | |

| Summary of Peer Group (Yr-end 2006) | | | 2006Y | | | 3 Yr | | | | 2006Y | | | | 2006Y | |

| Average | | | 1,069,305 | | | | 84.4 | % | | | 0.96 | % | | | 10.4 | % |

| 50th Percentile | | | 990,350 | | | | 54.4 | % | | | 0.90 | % | | | 9.6 | % |

| MidSouth Bancorp, Inc. | | | 805,022 | | | | 86.0 | % | | | 1.08 | % | | | 14.7 | % |

In order to provide a more current perspective we present the year-end results, as available, for our peer group as of year-end 2008 in the following table. During 2008, we continued to compare favorably to peers on measures used to create the peer group in 2006.

Benchmarking Peer Group (as of year-end 2008)(1)

| | | | | | | | Total Assets | | | Asset Growth | | | ROAA | | | ROAE | |

| | | | | | | | | 2008Y | | | 3 Yr | | | | 2008Y | | | | 2008Y | |

| | | Company Name | Ticker | City | State | | $ | (000 | ) | | (%) | | | (%) | | | (%) | |

| | 1 | | First M&F Corporation | FMFC | Kosciusko | MS | | | 1,596,865 | | | | 26.0 | | | | 0.03 | | | | 0.37 | |

| | 2 | | Great Florida Bank | GFLBA | Coral Gables | FL | | | 1,843,867 | | | | 83.3 | | | | -1.12 | | | | -11.34 | |

| | 3 | | ViewPoint Financial Group (MHC) | VPFG | Plano | TX | | | 2,213,447 | | | | 55.0 | | | | 0.30 | | | | 2.95 | |

| | 4 | | Southern Community Financial Corporation | SCMF | Winston-Salem | NC | | | 1,803,778 | | | | 40.1 | | | | 0.34 | | | | 4.02 | |

| | 5 | | BancTrust Financial Group, Inc. | BTFG | Mobile | AL | | | 2,088,177 | | | | 59.9 | | | | 0.06 | | | | 0.50 | |

| | 6 | | Encore Bancshares, Inc. | EBTX | Houston | TX | | | 1,587,844 | | | | 20.6 | | | | -0.54 | | | | -4.96 | |

| | 7 | | TIB Financial Corp. | TIBB | Naples | FL | | | 1,610,114 | | | | 49.6 | | | | -1.36 | | | | -20.41 | |

| | 8 | | MetroCorp Bancshares, Inc. | MCBI | Houston | TX | | | 1,580,238 | | | | 40.1 | | | | 0.12 | | | | 1.50 | |

| | 9 | | CenterState Banks of Florida, Inc. | CSFL | Winter Haven | FL | | | 1,333,143 | | | | 53.0 | | | | 0.28 | | | | 2.21 | |

| | 10 | | Florida Community Banks, Inc. | FLRB | Immokalee | FL | | | -- | | | | -- | | | | -- | | | | -- | |

| | 11 | | Peoples Financial Corporation | PFBX | Biloxi | MS | | | 896,408 | | | | 6.0 | | | | 0.56 | | | | 4.77 | |

| | 12 | | Pulaski Financial Corp. | PULB | Saint Louis | MO | | | 1,304,150 | | | | 65.1 | | | | 0.23 | | | | 3.34 | |

| | 13 | | Peoples BancTrust Company, Inc. | PBTC | Selma | AL | | | -- | | | | -- | | | | -- | | | | -- | |

| | 14 | | Nexity Financial Corporation | NXTY | Birmingham | AL | | | 1,061,580 | | | | 35.3 | | | | -1.27 | | | | -20.14 | |

| | 15 | | Bank of Florida Corporation | BOFL | Naples | FL | | | 1,549,013 | | | | 171.9 | | | | -0.93 | | | | -6.70 | |

| | 16 | | First Federal Bancshares of Arkansas, Inc. | FFBH | Harrison | AR | | | 795,172 | | | | -6.7 | | | | 0.31 | | | | 3.38 | |

| | 17 | | Federal Trust Corporation | FDTR | Sanford | FL | | | -- | | | | -- | | | | -- | | | | -- | |

| | 18 | | United Security Bancshares, Inc. | USBI | Thomasville | AL | | | 668,002 | | | | 7.5 | | | | 0.80 | | | | 6.83 | |

| | 19 | | Auburn National Bancorporation, Inc. | AUBN | Auburn | AL | | | 745,970 | | | | 22.7 | | | | 0.92 | | | | 12.06 | |

| | 20 | | Sun American Bancorp | SAMB | Boca Raton | FL | | | 590,927 | | | | 113.2 | | | | -8.69 | | | | -58.26 | |

| | | | Average | | | | | | 1,368,747 | | | | 49.6 | | | | -0.59 | | | | -4.70 | |

| | | | 50th Percentile | | | | | | 1,549,013 | | | | 40.1 | | | | 0.12 | | | | 1.50 | |

| | | | MidSouth Bancorp, Inc. | MSL | Lafayette | LA | | | 936,815 | | | | 34.1 | | | | 0.60 | | | | 7.79 | |

(1) Data for Florida Community Banks, Inc. and Federal Trust Corporation was unavailable at the time of the filing of this document. People’s Banctrust Company Inc, (PBTC) was acquired by BancTrust Financial Group, Inc. on October 15, 2007.

Although we did not modify the nature of our compensation programs for our NEOs during 2008, we did use the information from the review, in conjunction with the survey market data,were required to make decisions related to base salary levels in 2008. The review will also be used on a going forward basis with respect to any updates or modificationscertain changes to executive compensation programsarrangements as necessary to comply with the provisions of the EESA. These restrictions and prohibitions apply to various officers, as discussed in 2009.greater detail below.

Elements of Compensation Philosophy

We believe it is in the best interest of our shareholders and us to provide competitive compensation to attract and retain the most qualified executive officers with demonstrated leadership abilities that will secure our future. We do this by providing compensation that is tied to our short and long-term performance goals to motivate our executive officers to attain these goals.

The Our policy is to provide a large portion of compensation in cash, including an annual base salary and an opportunity to receive an annual incentive that is based on earnings per share (“EPS”). We provide this to keep the executive officers focused on current earnings and stability and to strongly align the executives with the interests of our shareholders. We target executive salaries at the 50th percentile of the market. Cash compensation (salary + cash incentives) and direct compensation (cash compensation + equity incentives) are targeted at the 50th percentile of the market when target performance goals are achieved and at the 75th percentile of the market when maximum performance goals are achieved.

As a participant in the CPP, the Company is subject to certain restrictions and limitations on the compensation it may provide to certain executive officers and other employees. Accordingly, the Company’s compensation programs must be designed and administered in compliance with these restrictions and limitations for as long as the Company remains subject to them. Additionally, as a financial institution, we must abide by any other rules, regulations or guidelines that we examine may include credit quality, credit risk management, deposit growth,be imposed by bank regulatory compliance, return on equity, and growthauthorities in our assets and income.the area of compensation.

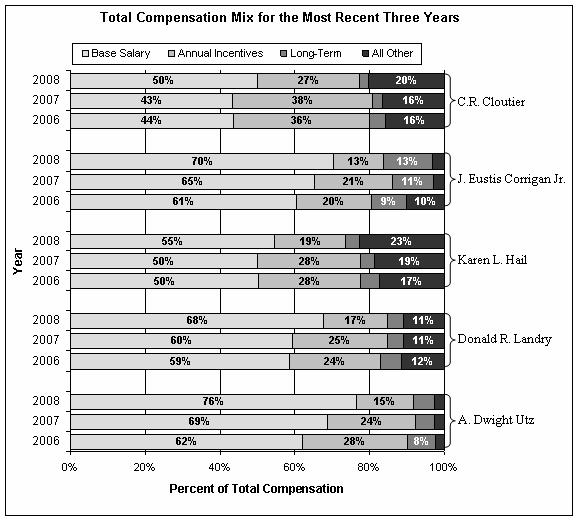

Elements of Compensation

We have not made any material changes in individual compensation in 20082009 compared to 2007.2008. The elements of compensation used during 20082009 to compensate the executive officers include:

| · | Base Salary;Salary – fixed base pay that reflects each officer’s position, individual performance, experience, and expertise. |

| · | Annual Incentives;Incentives – cash awards that vary based upon EPS performance under the Company’s Incentive Compensation Plan (CICP). |

| · | Retirement Benefits;Long-term Incentives – equity-based awards (historically stock options) under the 2007 Omnibus Incentive Plan that provide a reward for increases in the stock price. No equity awards were made in 2009. |

| · | HealthRetirement Benefits – includes the employee stock ownership plan (ESOP), 401(k) retirement plan, and Insurance Plans;Executive Indexed Salary Continuation Agreements for Mr. Cloutier, Ms. Hail, and Mr. Landry. Mr. Cloutier and Ms. Hail also participate in the Director Deferred Compensation Plan. |

| · | Long-term Equity Awards;Other Compensation – certain executives receive additional benefits and perquisites such as split dollar life insurance, supplemental term life insurance, supplemental disability insurance, company car, moving expenses, uniform allowance, cell phone, board of director fees, and club memberships. |

Process for Determining Executive Officer Compensation

• Role of the Personnel Committee and the Executive Officers. The Personnel Committee administers our executive compensation programs. The Personnel Committee annually reviews and recommends the levels, performance goals, and strategic objectives, relating to compensation of the Chief Executive Officer to our Board. Final approval on the CEO’s compensation is made by the full Board. The Personnel Committee also consults with the CEO on the compensation levels of the other executive officers. Based on these discussions, the Personnel Committee along with the CEO recommends the compensation levels for the other NEOs to the Board.

The Personnel Committee periodically reviews our incentive plans and other equity based plans. The Personnel Committee reviews, adopts, and submits to the Board any proposed arrangement or plan and any amendment to an existing arrangement or plan that provides or will provide benefits to the executive officers collectively or to an individual executive officer. The Personnel Committee has sole authority to retain and terminate a compensation consultant or other advisor as the Personnel Committee deems appropriate.

The Company, through the Personnel Committee, has the sole discretion: (a) to determine whether and to what extent any NEO compensation plans covering the Executive encourage taking unnecessary and excessive risks that threaten the value of the Company; (b) to determine whether

and to what extent any other employee compensation plans covering the Executive pose risks to the Corporation that should be limited; (c) to determine whether and to what extent any compensation plans covering the Executive encourage the manipulation of reported earnings and; (d) to limit or eliminate any compensation or compensation plan based on these determinations. The Personnel Committee has concluded that the current structure of all of the Company’s employee compensation plans do not contribute to excessive risk taking that could reasonably be expected to have a material adverse effect on the Company.

During 2009, the Personnel Committee consisted of Will Charbonnet, Sr. (Chairman), James R. Davis, Jr., J. B. Hargroder, M.D., Joseph V. Tortorice, Jr., and R. Glenn Pumpelly. The members of the Personnel Committee all qualify as independent, outside members of the Board in accordance with the requirements of the NYSE Amex, current SEC regulations and section 162(m) of the Internal Revenue Code.

• Role of the Compensation Consultant. The Personnel Committee has historically engaged a compensation consultant to provide input on executive compensation issues. In 2009, the Personnel Committee retained Amalfi Consulting, an independent third-party consulting company specializing in providing compensation consulting services to financial institutions, for the following projects: overall compensation review for executives, advisory services for CPP, and advisory services for employment agreements. For these projects Amalfi consultants reported directly to the Personnel Committee. Amalfi Consulting was engaged by management to conduct a cash compensation review for management. Amalfi was als o engaged by management and the Personnel Committee to design a new cash and equity incentive plan.

• Benchmarking. To ensure the competitiveness of our total compensation package, in 2009 the Personnel Committee engaged Amalfi Consulting to review its executive and officer total compensation, which provided compensation data for four of the NEOs (CEO, CFO, COO, CLO) as well as two other top officers. This review included data on salary, cash compensation (salary and annual cash incentives), direct compensation (cash compensation and all forms of equity compensation), and total compensation (direct compensation and all other forms of compensation). The Company’s proxy peer group was established and industry salary surveys were utilized in the report. The peer group was created based on the following c riteria that we believe reflect companies within our industry with similar size, strategy and geographic locations:

| · | Publicly traded financial institutions; |

| · | Locations in the states of: AL, AR, FL, KS, LA, MO, MS, NC (only SCMF), OK, TN & TX; |

| · | NPAs/Assets less than 5%; |

| · | $400 million - $3 billion in assets; and |

| · | Perquisites.Comparable business model and performance results. |

Below is a discussion of each elementShaded banks were used in our prior peer group, and were determined to still be an appropriate peer comparison. Prior peers that did not meet the criteria listed above were removed.

| | | Company | Ticker | City | State | | Total Assets 2008Y ($000) | | | Total Assets LTM 9/2009 ($000) | | | ROAA LTM 9/2009 (%) | | | ROAE LTM 9/2009 (%) | | | NPAs/ Assets LTM 9/2009 (%) | |

| | 1 | | Southside Bancshares, Inc. | SBSI | Tyler | TX | | | 2,700,238 | | | | 2,941,563 | | | | 1.69 | | | | 26.55 | | | | 0.75 | |

| | 2 | | Great Southern Bancorp, Inc. | GSBC | Springfield | MO | | | 2,659,923 | | | | 3,726,996 | | | | 1.74 | | | | 22.26 | | | | 1.73 | |

| | 3 | | Home BancShares, Inc. | HOMB | Conway | AR | | | 2,580,093 | | | | 2,631,736 | | | | 0.37 | | | | 2.90 | | | | 1.97 | |

| | 4 | | Southern Community Finan’l Corp. | SCMF | Winston-Salem | NC | | | 1,803,778 | | | | 1,725,341 | | | | -2.88 | | | | -36.14 | | | | 2.36 | |

| | 5 | | TIB Financial Corp. | TIBB | Naples | FL | | | 1,610,114 | | | | 1,717,622 | | | | -1.71 | | | | -25.92 | | | | 7.07 | |

| | 6 | | First M&F Corporation | FMFC | Kosciusko | MS | | | 1,596,865 | | | | 1,676,469 | | | | -2.26 | | | | -26.09 | | | | 6.05 | |

| | 7 | | Encore Bancshares, Inc. | EBTX | Houston | TX | | | 1,587,844 | | | | 1,600,720 | | | | -0.62 | | | | -5.32 | | | | 2.83 | |

| | 8 | | MetroCorp Bancshares, Inc. | MCBI | Houston | TX | | | 1,580,238 | | | | 1,629,732 | | | | -0.28 | | | | -2.93 | | | | 4.05 | |

| | 9 | | Wilson Bank Holding Company | WBHC | Lebanon | TN | | | 1,406,786 | | | | 1,441,111 | | | | 0.83 | | | | 8.98 | | | | 1.03 | |

| | 10 | | CenterState Banks, Inc. | CSFL | Davenport | FL | | | 1,333,143 | | | | 1,783,823 | | | | -0.13 | | | | -1.13 | | | | 3.61 | |

| | 11 | | First Citizens Bancshares, Inc. | FIZN | Dyersburg | TN | | | 927,502 | | | | 942,567 | | | | 0.92 | | | | 10.79 | | | | 1.43 | |

| | 12 | | First Farmers and Merchants Corp. | FFMH | Columbia | TN | | | 911,137 | | | | 931,474 | | | | 0.78 | | | | 6.78 | | | NA | |

| | 13 | | Peoples Financial Corporation | PFBX | Biloxi | MS | | | 896,408 | | | | 888,482 | | | | 0.52 | | | | 4.47 | | | | 3.15 | |

| | 14 | | Cass Information Systems, Inc. | CASS | Bridgeton | MO | | | 885,228 | | | | 1,033,395 | | | | 1.83 | | | | 15.14 | | | | 0.38 | |

| | 15 | | First Guaranty Bancshares, Inc. | FGYH | Hammond | LA | | | 871,432 | | | | 934,928 | | | | 0.69 | | | | 9.31 | | | | 1.14 | |

| | 16 | | Citizens Holding Company | CIZN | Philadelphia | MS | | | 766,047 | | | | 819,338 | | | | 0.96 | | | | 10.37 | | | | 1.68 | |

| | 17 | | Auburn National Bancorporation, Inc. | AUBN | Auburn | AL | | | 745,970 | | | | 786,042 | | | | 0.41 | | | | 5.72 | | | | 1.75 | |

| | 18 | | United Security Bancshares, Inc. | USBI | Thomasville | AL | | | 668,002 | | | | 695,226 | | | | 0.85 | | | | 7.20 | | | | 4.84 | |

| | 19 | | Landmark Bancorp, Inc. | LARK | Manhattan | KS | | | 602,213 | | | | 603,921 | | | | 0.48 | | | | 5.56 | | | | 2.33 | |

| | 20 | | First Bancshares, Inc. | FBMS | Hattiesburg | MS | | | 474,824 | | | | 485,889 | | | | 0.32 | | | | 3.80 | | | NA | |

| | | | Average | | | | | | 1,330,389 | | | | 1,449,819 | | | | 0.23 | | | | 2.12 | | | | 2.68 | |

| | | | 25th Percentile | | | | | | 845,086 | | | | 871,196 | | | | -0.17 | | | | -1.58 | | | | 3.50 | |

| | | | 50th Percentile | | | | | | 1,130,323 | | | | 1,237,253 | | | | 0.50 | | | | 5.64 | | | | 2.15 | |

| | | | 75th Percentile | | | | | | 1,600,177 | | | | 1,719,552 | | | | 0.87 | | | | 9.58 | | | | 1.49 | |

| | | | MidSouth Bancorp, Inc. | MSL | Lafayette | LA | | | 936,815 | | | | 947,830 | | | | 0.48 | | | | 5.01 | | | | 1.73 | |

| | | | Percent Rank | | | | | | 47 | % | | | 42 | % | | | 47 | % | | | 45 | % | | | 65 | % |

• Pay Level and Benchmarking Process. To evaluate executive pay, the Personnel Committee considers data collected on external competitive levels of compensation listed above, includingand internal relationships within the purpose of each element of compensation, why we elect to pay each element of compensation, how each element of compensation was determined by theexecutive group. The Personnel Committee and how each element and ourmakes decisions regarding individual executives’ target total compensation opportunities based on the paymentneed to attract, motivate and retain an experienced and effective management team.

Although the Personnel Committee gains considerable knowledge about the competitiveness of the Company’s compensation programs through the benchmarking process and by conducting periodic studies, the Personnel Committee recognizes that each element relatefinancial institution is unique and that significant differences between institutions in regard to our goals.executive compensation practices exist.

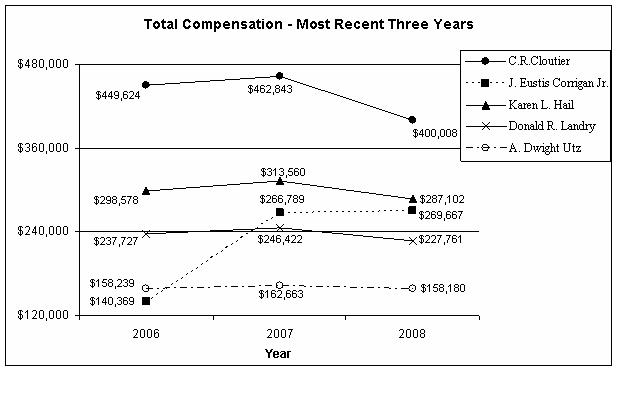

According to the report provided by Amalfi Consulting, salaries for the CEO, CFO, CLO and COO were 8% below the 50th percentile on average and total compensation amounts were at the market 50th percentile on average. However, the Personnel Committee noted that total compensation includes cash incentive awards that the CEO is no longer eligible to receive due to CPP participation. The primary data source used in evaluating competitive market levels for the NEOs was the customized peer group shown in the table above. This information was supplemented with banking industry survey data from Amalfi Consulting, Watson Wyatt, American Banker’s Association, Ban k Administration Institute, and Crowe Chizek.